SAN FRANCISCO - February 28, 2013 - Splunk Inc. (NASDAQ: SPLK), the leading software platform for real-time operational intelligence, today announced results for its fiscal fourth quarter and full year ended January 31, 2013.

"We are thrilled to cross the 5,000 customer mark worldwide by adding another 400-plus new Enterprise customers," said Godfrey Sullivan, Chairman and CEO. "It is gratifying to see our customer relationships evolve to enterprise-wide deployments as organizations choose to standardize on the Splunk platform for their machine-generated data."

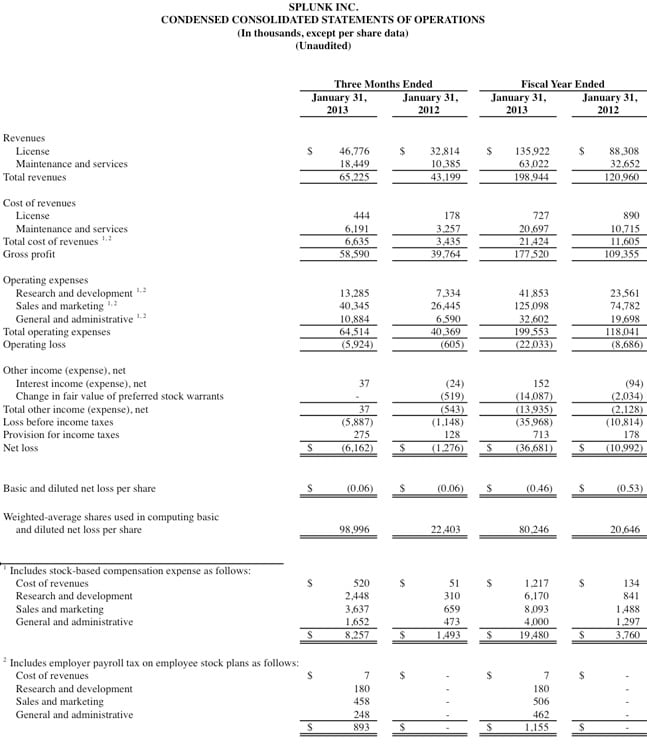

Fourth Quarter 2013 Financial Highlights

- Total revenue was $65.2 million, up 51% year-over-year.

- License revenue was $46.8 million, up 43% year-over-year.

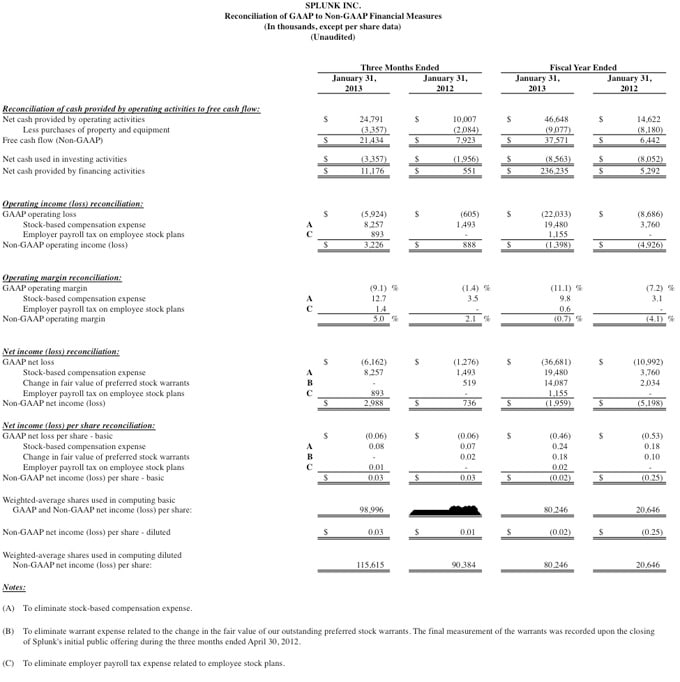

- GAAP operating loss was $5.9 million; GAAP operating margin was negative 9.1%.

- Non-GAAP operating income was $3.2 million; non-GAAP operating margin was 5.0%.

- GAAP loss per share was $0.06; non-GAAP income per share was $0.03.

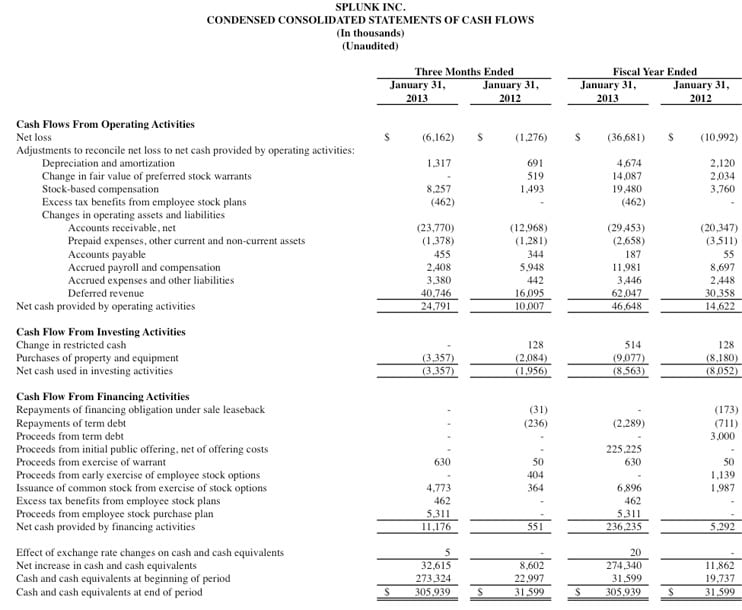

- Operating cash flow was $24.8 million with free cash flow of $21.4 million.

Full Year 2013 Financial Highlights

- Total revenue was $198.9 million, up 64% from prior year.

- License revenue was $135.9 million, up 54% from prior year.

- GAAP operating margin was negative 11.1%; non-GAAP operating margin was negative 0.7%.

- Operating cash flow was $46.6 million with free cash flow of $37.6 million.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the financial statement tables included in this press release.

Fourth Quarter 2013 and Recent Business Highlights

Customers:

New license customers include: DuPont, LAN Airlines, GOME Electrical Appliances (China), Idealo Internet GmbH (Germany), United States Computer Emergency Readiness Team (US-CERT), Palo Alto Networks, Poste Italiane SPA, City and County of San Francisco - Security Services, City of Chandler Police Department, City of Dayton, the Korea Music Copyright Association, NEC Australia, Nexon (APAC), Parallax Fund, RailCorp, Sacramento Regional Transit, Savvis, Siemens Energy, State of Nevada, Svyaznoy Bank (Russia), State of Montana, T-Mobile Poland, TriZetto Corporation and University of South Australia.

Expansion customers include: U.S. Coast Guard, Aviva (UK), Monster Worldwide, China Construction Bank, Comcast Corporation, U.S. Environmental Protection Agency, Genentech, Boingo Wireless, SKY Italia, Homes.com, Kaspersky Lab (Russia), Meeza (Qatar), Moody's, Robert Bosch GmbH, Row Sham Bow, State of Vermont, Symantec and Telenor Norway.

Product:

- Released the Splunk App for Enterprise Security 2.2 to take advantage of Splunk Enterprise 5 features, enabling improved scalability for large deployments, faster performance and easier third-party threat intelligence feeds. It also contains new and improved technology add-ons and is more tablet-friendly.

- Released the Splunk App for VMware 2.0 to enable deep operational visibility into granular performance metrics, logs, tasks, events and topology from hosts, virtual machines and virtual centers.

- Released the Splunk App for Palo Alto Networks 3.0 to enable users to leverage their machine-generated big data to analyze risk, improve security posture and compliance and address a number of additional operational and regulatory concerns.

- Announced the general availability (GA) of new software development kits (SDKs) for Java and Python. The Splunk SDK for PHP is in public preview.

- Released the GA version of Splunk DB Connect to deliver real-time integration between Splunk Enterprise and relational databases.

- Released Splunk Shuttl to give customers several backend options to archive their data, whether in Amazon S3, Hadoop HDFS or NFS. It allows data to move automatically and, via the user interface, locate and restore data with just a few clicks.

Awards:

- Fast Company named Splunk one of the World's Most Innovative Companies. Splunk is ranked fourth overall for "bringing big data to the masses." Fast Company also ranked Splunk the number one innovator in Big Data.

- Splunk Enterprise won the gold medal for the Best Security Product in the "2012 Editors' Best Awards" by Penton Media's Windows IT Pro. Splunk Enterprise was also awarded the silver medal for Best Free Tool and the bronze medal for Best Systems Monitoring Product.

- Named the 2012 Big Data Winner by Enterprise Strategy Group.

Appointments:

- Announced Tim Mather as the company's first Vice President of Security and Compliance Markets and Chief Information Security Officer (CISO).

Splunk4Good:

- Launched the Federal Election Commission Campaign Contribution Explorer to examine who gives the most to political campaigns by occupation, location and other criteria.

- Partnered with Rock the Vote to help young voters, who get a majority of their news via social media, better follow and understand the online conversation around the 2012 U.S. election campaign. Rock the Vote and Splunk4Good worked together to build a visualization that displayed sets of real-time political data to build a unique social media view to track the issues that young voters were discussing online.

- Selected to participate in the FEMA Innovation Think Tank to deliver social media metrics around the impact of Hurricane Sandy.

Financial Outlook

The company is providing the following guidance for its fiscal 2014 first quarter (ending April 30, 2013):

- Total revenue is expected to be between $52 million and $54 million.

- Non-GAAP operating margin is expected to be between negative 10% and negative 12%.

The company is providing the following guidance for its fiscal 2014 full year (ending January 31, 2014):

- Total revenue is expected to be between $260 million and $270 million.

- Non-GAAP operating margin is expected to be approximately zero.

All forward-looking non-GAAP financial measures contained in this section "Financial Outlook" exclude estimates for stock-based compensation expenses and employer payroll tax expense related to employee stock plans. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis.

Conference Call and Webcast

Splunk's executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company's financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk's Investor Relations website at http://investors.splunk.com/events.cfm. A replay of the call will be available through March 7, 2013 by dialing (855) 859-2056 and referencing Conference ID# 93605971.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk's revenue and non-GAAP operating margin targets for the company's fiscal first quarter and fiscal year 2014 in the paragraphs under "Financial Outlook" above, and other statements regarding momentum in the company's business, growth in the number of new customers, existing customer usage, expansion of Splunk software and product developments. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: Splunk's limited operating history, particularly as a relatively new public company; risks associated with Splunk's rapid growth, particularly outside of the U.S.; and general market, political, economic and business conditions.

Additional information on potential factors that could affect Splunk's financial results is included in the company's Quarterly Report on Form 10-Q for the quarter ended October 31, 2012 which is on file with the U.S. Securities and Exchange Commission. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

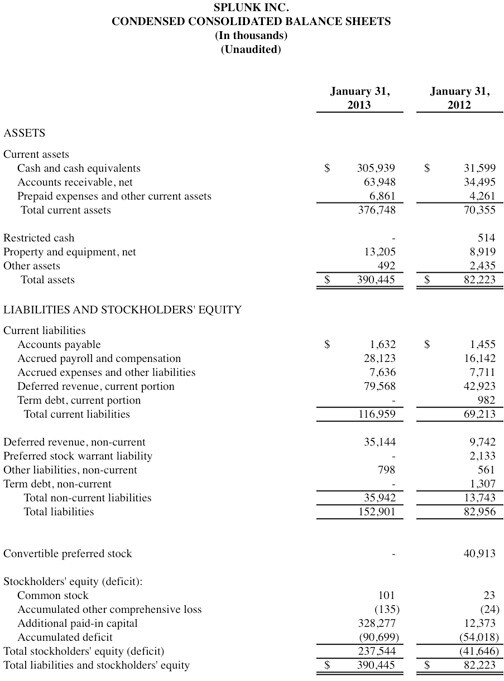

SPLUNK INC.

Non-GAAP financial measures and reconciliations

To supplement Splunk's consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"), Splunk provides investors with certain non-GAAP financial measures, including non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss) and non-GAAP net income (loss) per share (collectively the "non-GAAP financial measures"). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation table): stock-based compensation expense, employer payroll tax expense related to employee stock plans, amortization of acquired intangible assets, ground lease expense related to a build-to-suit lease obligation, impairment of a long-lived asset, acquisition-related costs and the partial release of the valuation allowance due to acquisition. In addition, non-GAAP financial measures include free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk's operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors' operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk's operational performance. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under FASB ASC Topic 718, Splunk believes that providing non-GAAP financial measures that exclude this expense allows investors the ability to make more meaningful comparisons between Splunk's operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk's operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk's common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk's business. Splunk also excludes the non-cash charge for previously capitalized Storm research and development expense (reflected as an impairment of a long-lived asset) as a result of its strategic decision to start making its Storm product available at no cost to customers, a decision that Splunk expects to be infrequent in nature. Splunk also excludes acquisition-related costs, amortization of acquired intangible assets and ground lease expense related to its build-to-suit lease obligation from its non-GAAP financial measures because these are considered by management to be outside of Splunk's core operating results. Splunk further excludes the partial release of the valuation allowance due to acquisition from non-GAAP net income (loss) and non-GAAP net income (loss) per share because it is also considered by management to be outside Splunk's core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk's competitors and exclude expenses that may have a material impact upon Splunk's reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk's business and an important part of the compensation provided to Splunk's employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following table reconciles Splunk's non-GAAP results to Splunk's GAAP results included in this press release.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) provides the engine for machine data™. Splunk® software collects, indexes and harnesses the machine-generated big data coming from the websites, applications, servers, networks and mobile devices that power business. Splunk software enables organizations to monitor, search, analyze, visualize and act on massive streams of real-time and historical machine data. More than 5,200 enterprises, universities, government agencies and service providers in over 90 countries use Splunk Enterprise to gain Operational Intelligence that deepens business and customer understanding, improves service and uptime, reduces cost and mitigates cybersecurity risk. Splunk Storm™, a cloud-based subscription service, is used by organizations developing applications in the cloud.

To learn more, please visit www.splunk.com/company.

Splunk, Splunk>, Listen to Your Data, The Engine for Machine Data, Hunk, Splunk Cloud, Splunk Light, SPL and Splunk MINT are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2015 Splunk Inc. All rights reserved.